2.3 Managing

your Forms

Year-End Forms allows you to View, Edit, Delete, and Print

any of your forms. This may be useful to correct forms, print individual forms,

or review an employee/recipient’s tax form. As indicated above, Forms may be

accessed through the Forms icon within the navigation bar.

![]() The

Task-Driven Homepage (detailed further in Section 2.4) also

features a ‘My [Tax Forms]’ button. This button will navigate you to the ‘View

Forms’ page as well.

The

Task-Driven Homepage (detailed further in Section 2.4) also

features a ‘My [Tax Forms]’ button. This button will navigate you to the ‘View

Forms’ page as well.

2.3.1 Viewing Forms

From this page, you can search for any form using a variety of

filters. Clicking ‘More Options’ allows to you search by an expanded set of

options based on the formset type. Clicking ‘Find’ will return a list of each

of your employees/vendors found under the search criteria. At this point, you

can export the list to Excel or edit and print a single form.

2.3.2

Print

an Individual Form

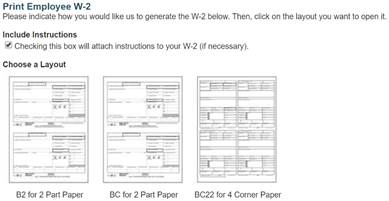

![]()

To print an individual employee/recipient’s form, select the

‘Print’ link next to the form you wish to print. This will generate the tax

form as a PDF document, which may be printed directly or saved as a PDF

document for printing later. This option will also allow you select from the

multiple form layout options that Year-End Forms supports and that has been

enabled within the Forms setting.

For the W-2 specifically, this includes:

·

B2 (two Copy Bs) for 2-part paper

·

BC (one Copy B and one Copy C) for 2-part paper

·

BC22 for 4-part paper (one Copy B, one Copy C,

and two Copy 2s).

You may find this option useful to print an

employee/vendor’s corrected form as well. Separate templates are available for

corrected forms, as needed.

2.3.3 Edit Forms

There are many reasons that an administrator may wish to

make edits to employee’s tax form. For example, you may discover there are

fields that were incorrect in your accounting package, or your employee may

report a problem and you have not given them access to change it themselves.

To edit a form, you must first search for it on the ‘View

Forms’ page as described in Section 2.3.1 above.

Once you have located the form, click on the ‘Edit’ link next to the form you

wish to edit.

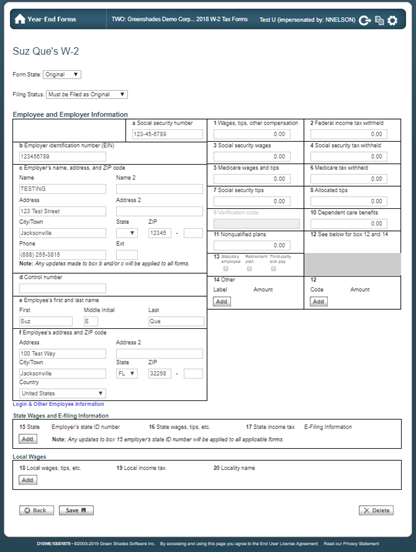

![]()

Your form will appear populated with the data for the

employee/vendor you selected. Depending on the form type, multiple links will

be provided to edit the form’s information. Any warnings or validation errors

for the form should be listed at the top of the screen. To edit a section of

the form, depending on formset type, find the nearest 'Edit' link that

describes what you want to edit or click within the text field you wish to

edit.

For example, if you want to edit an employee's wages, you

should click within Box 1 and edit the data. You may also edit other

information, such as Login & Other Employee Information (needed for

employee access) by clicking the link and editing the information within the

pop-up modal.

Once an edit is

saved, it will be reflected everywhere. This includes the form that you are

viewing, the form that the employee may electronically view through

GreenEmployee.com, and the E-File that will be submitted, once it is due. It

is, however, important to note that any changes/edits made to tax forms within

the Year-End Forms portal will not sync back to your accounting package.

A form may also be

deleted through the ‘Edit Form’ page within the bottom action bar. It is

important to note that on confirmation of deleting a form, it will be

irreversible.

![]()

An audit of all changes

made to any forms within your formset is stored by Year-End Forms. This

includes tracking of changes made by recipients, as well as form edits by

administrators. You can view this report by clicking on the ‘Reports’ button on

the task-driven homepage and clicking on the ‘Changes

made to forms’ report. You may also

filter this report by who made the change and export it into Excel. For more on

reports, see Section 5.

2.3.4 Making

Form Corrections

While Section 2.3.3 details

how to make edits to your tax forms, this section specifically details how to

make form corrections for W-2 formsets.

If you need to make corrections to a form/forms for your

employee(s)/vendor(s), Year-End Forms has several options to support your

needs.

2.3.4.1

W-2

Corrections

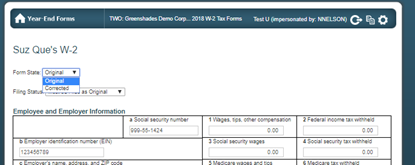

For W-2 forms, you must send a

corrected form to your employees if you make a change to their form

information/data post-distribution. Based on distribution and filing status of

the employee and the formset, Year-End Forms will automatically determine the

correction status of an employee’s form and display it as such at the top of

the employee’s ‘Edit Form’ page.

On proceeding distribution through Print an Individual Form, Download and Print, Mail Service, or Employee

Access view, the appropriate, compliant form will display/generate based on

the form’s status below.

There are two categories that a

correction to a W-2 form may fall into:

1)

Form State:

§

Form State Original:

No significant changes have been made to an employee form that the IRS

would identify as needing a correction form prior to distribution.

§

Form State

Corrected: A change is made to an employee’s form that the IRS has

identified as a significant change that the employee should have accurately

reflected on their W-2 form as to accurately report on their 1040 return.

Example: Employee SSN, Employer EIN, Box

1-20 data

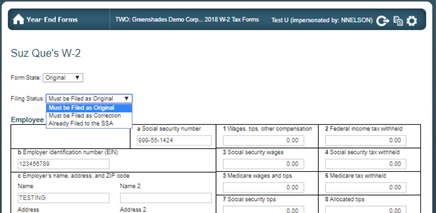

2)

Filing Status:

§

Must be Filed as

Original – This form will be included in the next original filing

created and sent to the SSA.

§

Must be Filed as

Correction- This form has detected a change made to an employee’s form,

post-filing, that the IRS has identified as a significant change that the

employee now requires a correction filing to detail what was Previously

Reported on the originally distributed form and what the Correct Information is

that will be re-E-filed and reported to the SSA.

Example: Employee SSN, Employer EIN, Box

1-20 data. This form will be included in the next correction filing created

and sent to the SSA.

§

Already Filed to the

SSA: This form has already been included in a filing. This form will not be included in any future filings.

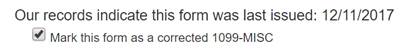

2.3.4.2

1099-Misc

Corrections

For 1099-MISC forms, you must send

corrections to your vendors if you make a change to a vendor's TIN or any wage

information. When an edit is made to a vendor’s form, mark the form as

Corrected using the checkbox in the bottom right-hand corner. If the form has

previously been distributed and/or filed, thus requiring the correction, this

section will display when the form was last issued/distributed.

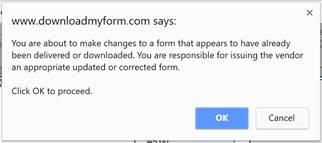

Year-End Forms

recognizes if the form has been previously distributed and on ‘Save’ will

display a confirmation modal to indicate to the administrator is responsible

for redistributing the corrected form.

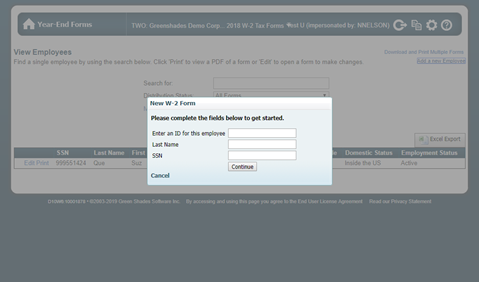

2.3.5 Manually

Add a New Form

You

may manually add a new employee/recipient to this formset by clicking the ‘Add

a new Employee’ link from the ‘View Forms’ page. The ‘New W-2 Form’ modal will

capture the employee ID, Last Name, and SSN. Click ‘Continue’ to create the new

tax form and manually enter the employee’s personal and reportable tax

information.

This

new form will now be included in formset totals, distribution batches (if

selected), and original E-File.

For additional support please contact us.

(888) 255-3815 ext.1