3.1.5 Manage Employee Access

Only

available for W-2, 1095-C, and T4 formsets

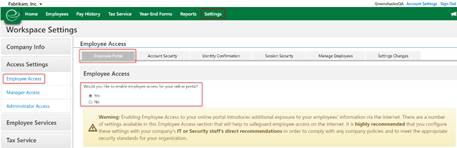

For formset types (W-2s, 1095-Cs, and T4s) that allow

employee access to view their tax form(s) electronically, there is a ‘Manage

Employee Access’ checklist task. By default, the Employee Access setting will

be disabled and require the admin to enable through the Employee Access setting (previously discussed in

Section 2.2.2.1) or through the Manage Employee Access checklist task that

will launch the administrator into the Employee Access Wizard.

If Employee Access has already been enabled through the

formset settings, it will carry-over and display as such within this task.

GreenEmployee.com will track employee access, manage all

electronic pre-consents/ consents, and provide employees the ability to view

and print their tax form(s). For a report of how many employees have consented

to receive electronic forms or have viewed their form electronically, see Section 5.1 to review ‘User Activity’

reports available through Year-End Forms.

Note: Greenshades also supports a web service that enables

companies to integrate their own websites, or a new website, with the Year-End

Forms portal to allow recipients of any form type to receive their form

electronically. Contact sales@greenshades.com

for more information.

3.1.1.1

Basic

Settings

It is important to note that you

may only enable Employee Access through the Year-Ends Forms portal if the

corresponding Employee Access setting in GreenshadesOnline.com is also enabled.

Clicking the ‘Full employee access settings can be managed on the Access

Settings page.’ link will navigate you to the GreenshadesOnline.com setting.

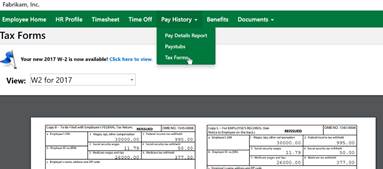

Once Employee Access is enabled,

those employees that have pre-consented or consented to receive their tax

form(s) electronically will be able to view their tax form through

GreenEmployee.com à

Pay History à

Tax Forms.

3.1.1.2

Turbo

Tax Setup

If you would like, Greenshades will

synchronize your employee year-end forms data to Turbo Tax. If you choose to synchronize

your forms, your employees will then be able to download their W-2 data

directly from Turbo Tax while completing their 1040. After beginning

synchronization, any changes you make to your forms will automatically

synchronize to Turbo Tax.

Please note that the

synchronization cannot be turned off once it has been activated; please make

sure your forms are ready to be viewed within Turbo Tax before you activate

synchronization.

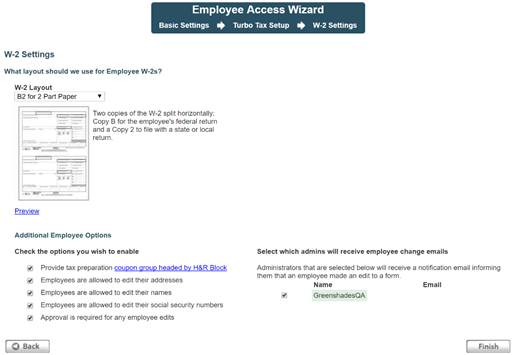

3.1.1.3

W-2/1095-C/T4

Settings

Form specific settings within the

Employee Access Wizard allow the administrator to choose which template layout

will display when employee’s electronically view their form.

There are also

additional options to:

·

Include a tax preparation coupon sheet with the

electronic tax form (with a preview of included vendor coupons)

o

Included coupons vary based on tax form

·

Allow employees to edit their address, name,

and/or SSN

·

Require administrator approval on employee edits

·

Elect to receive administrator notifications

when an employee edit is made

For additional support please contact us.

(888) 255-3815 ext.1