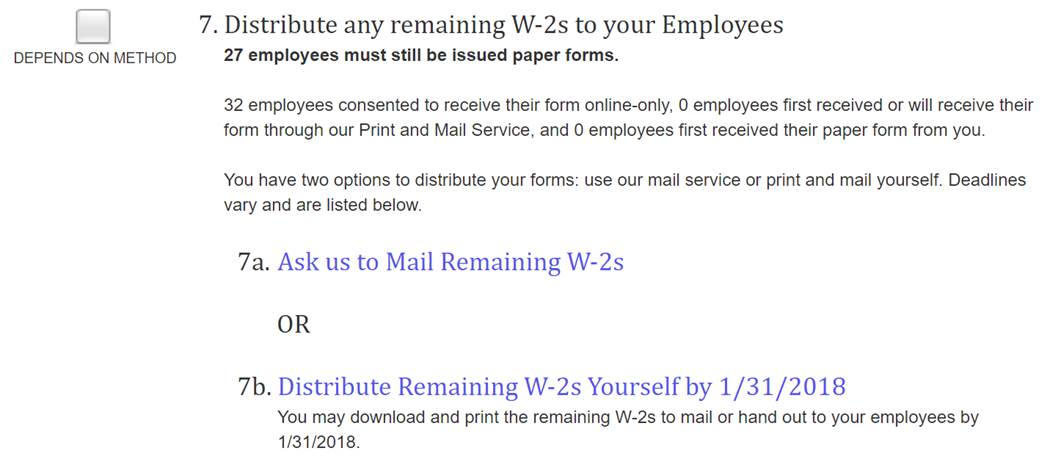

4 Distributing Year-End Forms

To begin the process of mailing, click the appropriate task link in the task-driven homepage checklist or on ‘Mail’ from the classic view homepage. This will allow you to see previous mail service orders submitted and create new ones.

To ensure your forms are postmarked by the appropriate deadline, please make sure to submit your mail order as soon as possible and before the Greenshades deadlines. These dates are posted in the Year-End Forms distribution checklist step.

4.1 Ask Greenshades to Mail Remaining Forms

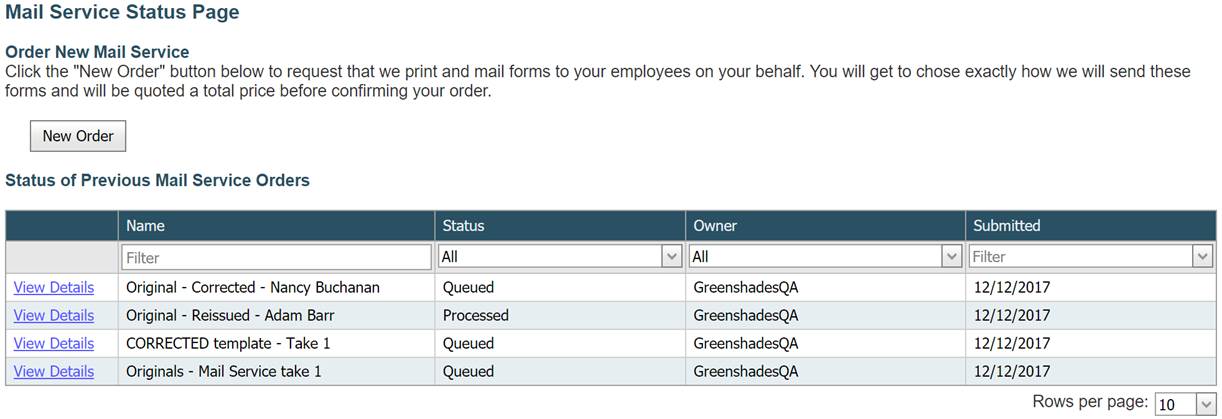

4.1.1 Previous Mail Service Orders

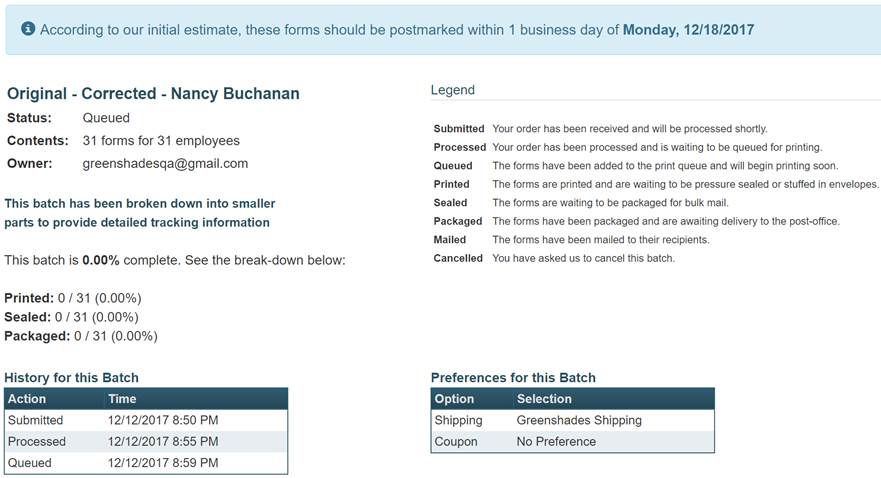

![]() To see the status and information regarding a previous order,

click on the ‘View Details’ link next to the batch you want to review.

To see the status and information regarding a previous order,

click on the ‘View Details’ link next to the batch you want to review.

The details page illustrated below will provide important information about the number of forms submitted, the status, the history of the batch, and the preferences selected at the time of submission. This is most useful to track the status of your order through our mail service process.

4.1.2 Submitting a New Mail Service Order to Greenshades

To begin a new Mail Service order, click the ‘New Order’ button

from the ‘Mail Service Status Page’. This will launch the Mail Service Wizard

where you can request that Greenshades print and mail forms to your employees

on your behalf.

To begin a new Mail Service order, click the ‘New Order’ button

from the ‘Mail Service Status Page’. This will launch the Mail Service Wizard

where you can request that Greenshades print and mail forms to your employees

on your behalf.

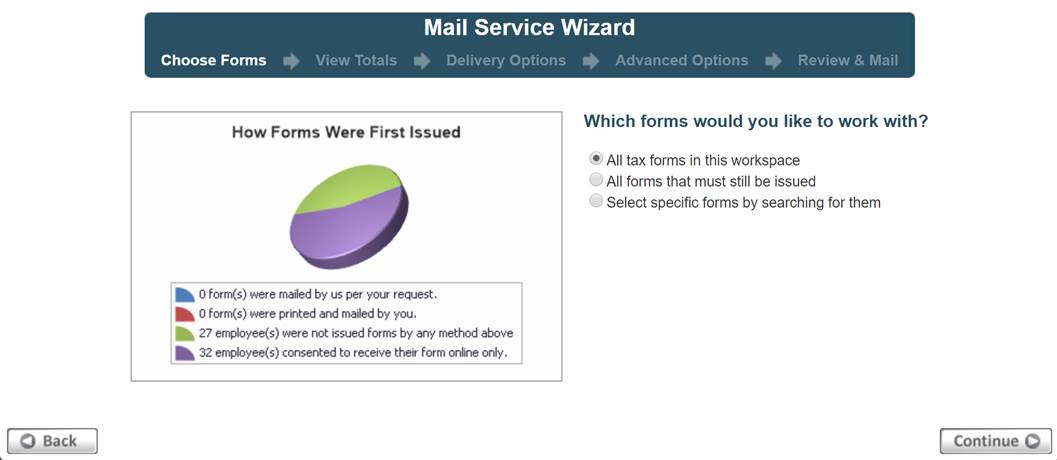

4.1.2.1

Choose

Forms

Choose which forms you wish to mail to your recipients.

· All tax forms in this workspace – Creates a complete set of forms for all employees in your formset

o If any forms within the formset have been edited/corrected and marked as such, you will receive an additional option to indicate if this batch should include the corrected forms or non-corrected forms.

§ If you require to distribute for both, you will need to submit two different orders.

· All forms that must still be issued - Mail forms that you

are required to still distribute (i.e. forms that have not already been

downloaded online or included in a Mail Service or Download and Print batch)

· Let me choose specific forms – Allows the administrator individually select the employee forms that they wish to send

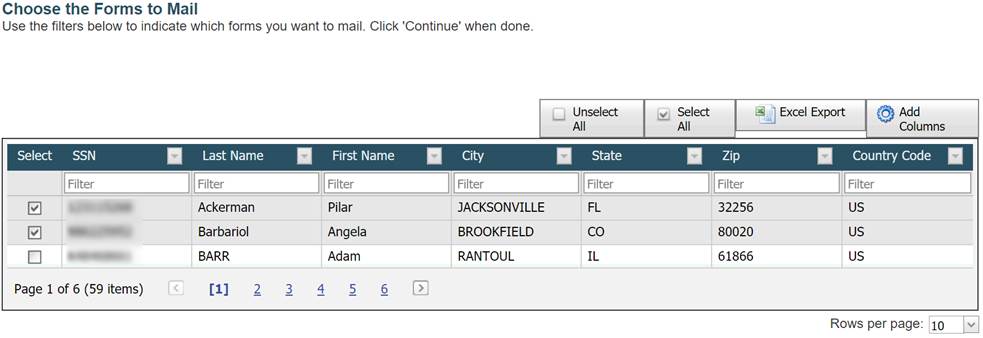

If you choose to select specific forms, this

page will provide a search/filtering feature, which allows the administrator to

search by various options/columns. If you have forms with different

distribution deadlines (such as the 1099-Misc), you will have a search option

to filter the list of forms to show only forms with a specific deadline date.

Once you have filtered this list of forms to the ones you wish to have

distributed, select ‘Continue’ to proceed.

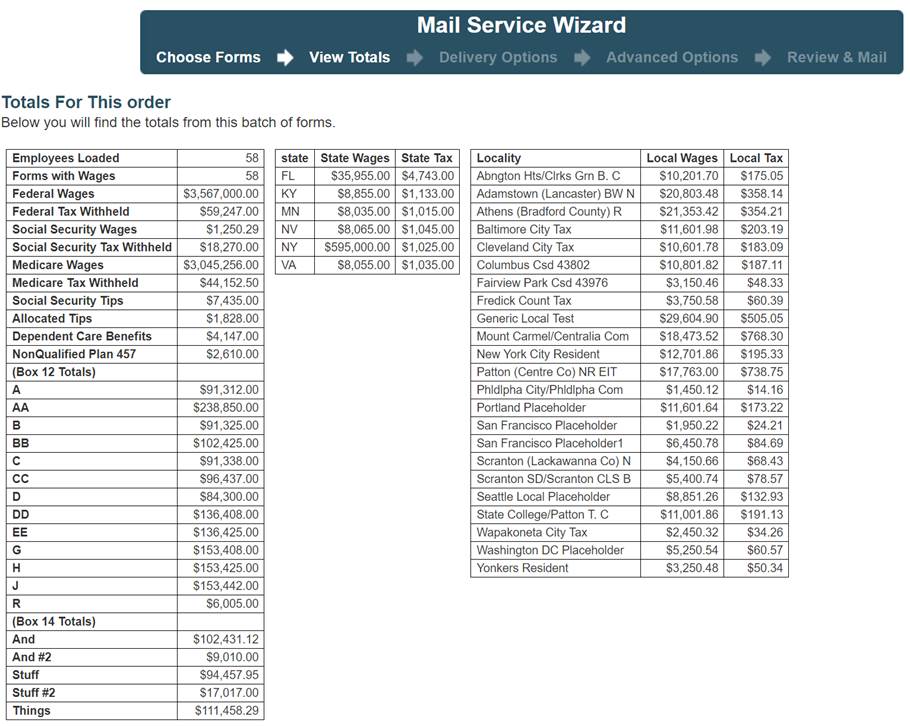

4.1.2.2

View

Totals

Based on the forms you selected, the next page will provide you with the totals for this order. This will include total forms loaded, totals amounts, and other important information. These totals represent the data that will be included on your forms and mailed to your recipients. Please review this information carefully to ensure accuracy before submitting the batch for Mail Service processing.

If

you agree with the totals, click ‘Continue’ to proceed.

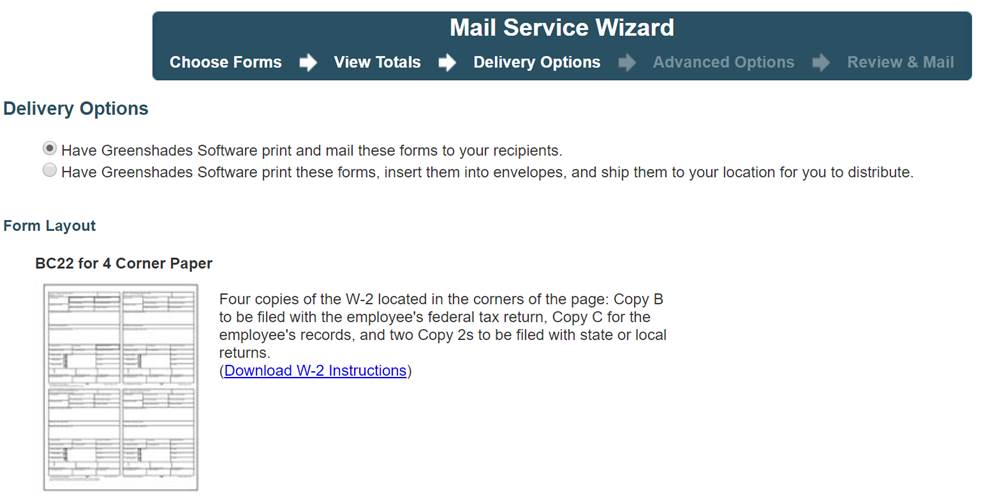

4.1.2.3

Delivery

Options

Greenshades Mail Service provides two options when you request that we distribute your tax forms:

1) Have Greenshades Software Print and Mail these forms to your recipients

· This

is typically the preferred option unless you intend on distributing the forms

to recipients in person.

2) Have Greenshades Software print these forms and ship them to your location for you to distribute.

· If you prefer for Greenshades to box and ship your forms through this option, please provide the shipping and contact information required.

4.1.2.4

Advanced

Options

The ‘Advanced Options’ page of the Mail Service Wizard is provided when there are additional options to review for your current forms. This page may not always appear, depending on form type.

For W-2s and 1099-MISCs, you are prompted to

select from the available preference options. This will cover whether to use

pressure-seal forms or paper and envelopes. Also, whether to include an H&R Block

(W-2s) or Tax Act (1099-Miscs) coupon on the form for your recipient. For any

option, you will always have the choice to not indicate a preference and allow

Greenshades to process forms as quickly as possible for expediency.

4.1.2.5

Review

and Mail

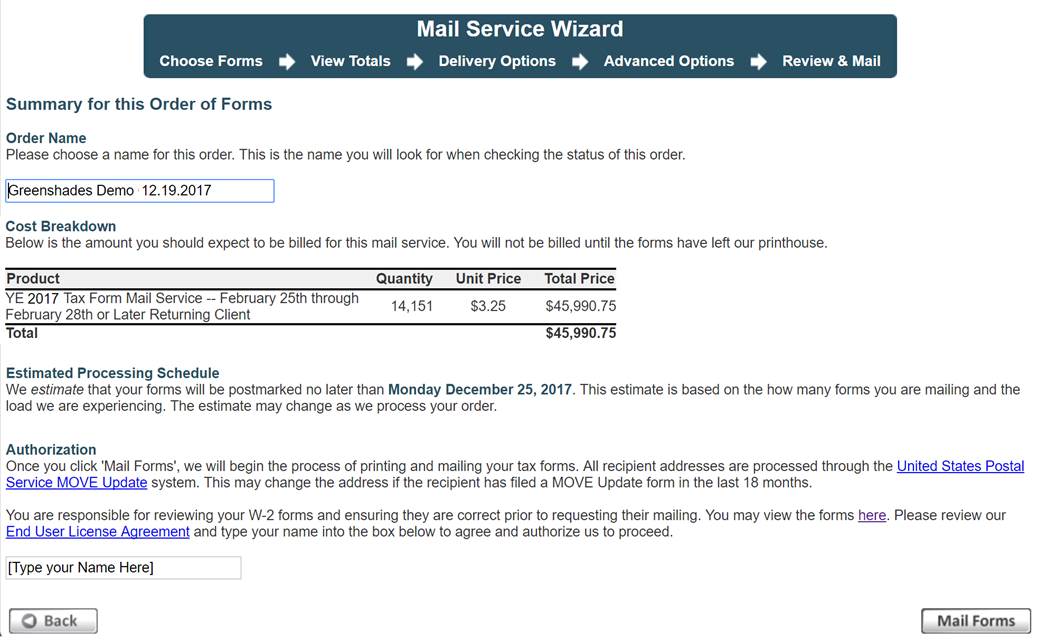

On the final page of the Mail Service Wizard, enter a uniquely identifiable name for this batch, review the cost breakdown, and to agree to the End User License Agreement. An estimated processing schedule will display as well to indicate when you can expect your tax forms to be postmarked by.

If you submit your mail service order prior to the Greenshades mail service deadline, your estimated processing schedule should list a date prior to the form delivery deadline. Otherwise, Greenshades will mail your forms as soon as possible. For more information about this year’s mail service deadline, please contact Greenshades Support.

For additional support please contact us.

(888) 255-3815 ext.1