About the Greenshades

Year-End Forms Process

The Greenshades Year-End Forms process uses a combination of

software, websites and government E-File services to ensure that employers can

complete all of their year-end tax form requirements

quickly and easily.

Most administrators have W-2s, 1099s, 1095-Cs, T4s, or other

forms stored in a corporate accounting package or perhaps manually

tracked/recorded in Microsoft Excel. The uploaded data, through either tracking

method, will be generated into digital tax forms, which can be edited, accessed

electronically by employees/vendors (as form type permits), automatically

printed and mailed by Greenshades, and/or E-Filed to the appropriate government

agency.

Year-End Forms is organized into formsets.

A formset contains all forms of a specific form type

(W-2, 1099-Misc, 1095-C, etc) for any individual

company and specified year. For example,

“Fabrikam 2018 W-2 forms” and “Contoso 2018 1099-MISC

forms” are each an individual formset that are

uploaded, accessed, and managed independently.

1 Getting

Started with Year-End Forms

1.1

Accessing

the Year-End Forms Portal

1.1.1 Existing

Administrator Account Access

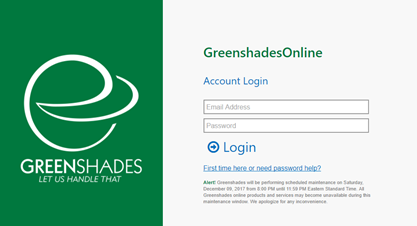

If

an existing administrator is completing the ‘Create Year-End Forms’ wizard from

the Tax Filing Center, they will be

provided a direct link to their online formsets

(either through product or through an email). The formset

pages may also be bookmarked from a web browser for easy access at a later time.

If

an existing administrator has completed a formset upload

through Microsoft Excel or otherwise, they can access the formset(s)

by signing in with their administrator credentials through

GreenshadesOnline.com

1.1.2 New

Administrator Account Creation

If an administrator is new and has never logged into

GreenshadesOnline.com, they will need to create an account before uploading or

managing accessible formsets. Administrators can

create their account at GreenshadesOnline.com by clicking the blue ‘First time

here or need password help?’ link.

Completing the steps through this link will send the

administrator an email with a link to create their account. The administrator

should complete the following steps to successfully create their account:

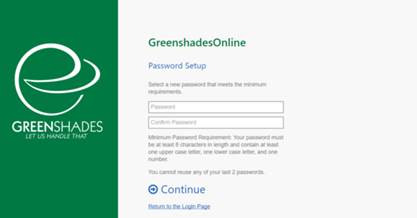

1.1.2.1

Password

Setup

This is the password the

administrator will use to log in to GreenshadesOnline.com in the future to

access company workspaces and formsets.

Minimum password requirements may

be set up and required to comply in order to continue.

1.1.2.2

Security

Question Setup

Two security questions will be required

to set up and will be used if the administrator needs to reset their password

in the future.

1.1.2.3

Security

Image Setup

This security image chosen will be

displayed when an administrator logs into GreenshadesOnline.com, so they know

they are at our secure website. If the displayed security image is different

and does not match the administrator selected security image, ensure you are

signing in through the authentic GreenshadesOnline.com sign-in portal and your

credentials are correct.

1.1.2.4

Success

Once the administrator has

successfully created their account, they will log in with their email address

and password.

![]() What happens if an administrator gets locked out of

their account?

What happens if an administrator gets locked out of

their account?

If an administrator gets locked out of their account,

they will need to reset their password. The administrator will follow the steps

below to reset their password.

![]() How do administrators reset their passwords?

How do administrators reset their passwords?

Administrators

can reset their password at any time using the same blue

‘First time here or need password help?’ link at GreenshadesOnline.com.

An

administrator’s password and security questions can also be managed once logged

in to GreenshadesOnline.com at the ‘Account Settings’ link in the top right-hand

corner.

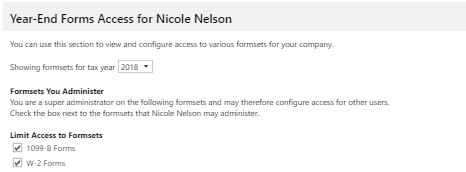

1.1.3

Controlling

Administrator Access

Administrator Access settings for formsets

can be managed through:

GreenshadesOnline.com à

Access Settings à

Administrator Access à

Access Control.

Formset access may be granted at a

Super Administrator level, which will allow the selected administrator to

access and manage all formsets associated with the

given workspace, or limited access may be set to restrict access to only specific

formset types or for specific years.

While

the Access Control settings give full control to administrator access rights,

during the upload formset process, either through the

Tax Filing Center (Section 1.2.1 –

Year-End Forms Wizard à Choose

Payroll Administrators step) or through Microsoft Excel (Section

1.2.2

– Import Forms Wizard à Security

step), you will be prompted to designate which administrator(s) should have

access to the new formset once uploaded.

1.2 Uploading

Forms

There are multiple ways to upload your forms into a Year-End

Forms formset based on the accounting package you use.

This guide will walk through uploading through the Greenshades Tax Filing

Center (Section 1.2.1) and by using the

Microsoft Excel (Section 1.2.2)

option.

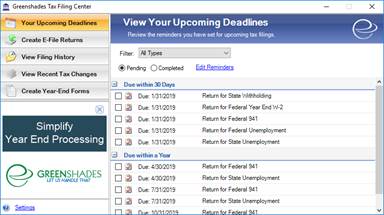

1.2.1

Uploading

forms through Greenshades Tax Filing Center

If you

already have the Greenshades Tax Filing Center installed and operating against

your payroll data, you may use the Tax Filing Center to import your forms to the

Year-End Forms portal. The Year-End Forms Wizard supports many form types. The

following instructions are provided for W-2s. Uploading forms of other form

types follows a similar path.

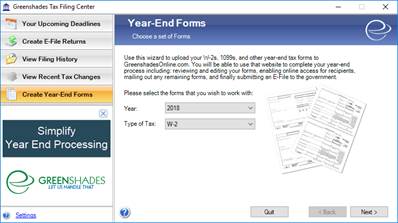

The ‘Year-End Forms’ wizard will ask what type of form you

wish to import for and, depending on the type of form and your accounting

package, may also ask you questions about how you would like your forms

imported.

Once you have selected the form type you wish to import, and

the appropriate year, click ‘Next’.

Next, you may be asked to

combine multiple GP companies, if applicable. Clicking ‘Yes’ will provide a

table of companies you may want to combine.

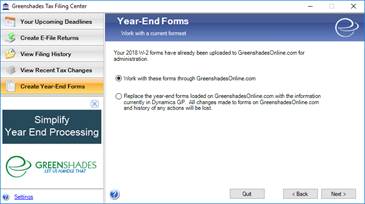

Once you have selected how you want the forms to be treated,

you will be provided the totals for the forms. Please verify that these totals

represent the form data you wish to upload to Year-End Forms. The next step is

to begin the upload process.

The upload process may take anywhere from 2-5 minutes based

upon the amount of forms you are uploading. You may need to allow for a longer

upload time based on size of file, amount of data, and internal internet

connection.

When the forms have

sucessfully imported, you will see a confirmation and be asked to click ‘Next’

to continue.

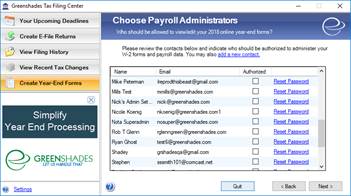

Once your forms have been uploaded, you will need to grant

administrator access to those forms. Check the checkbox in the ‘Authorized’

column next to each administrator who should have access to those forms. If an

administrator needs to be added to this list, click the ‘Add New Contact’ link.

If an existing administrator needs to reset their password, click the ‘Reset

Password’ link to do so.

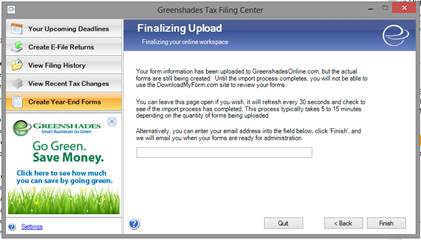

Your forms are being uploaded. Click the link provided on

this page to direct you to the Year-End Forms portal. You may now click the

‘Finish’ button to close the Greenshades Tax Filing Center or, alternatively,

provide an email address to receive a confirmation email when your upload has

successfully completed.

1.2.2

Uploading

using Microsoft Excel

If you do not have the Greenshades Tax Filing Center

installed, you may upload your forms through a Microsoft Excel format (.xls or.xlsx format). To upload your forms, download and

complete the Microsoft Excel template file tailored to the type of form you

want to upload.

You may click the link provided below or go online to either

GreenshadesOnline.com to access the Excel templates per form type. Either way,

you will finish in the Year-End Forms portal.

Click here to

download a Microsoft Excel template file

Enter your data into the Excel template you have downloaded.

Make sure that you do not modify the columns, column headers, or formatting, as

this may render the format incompatible for importing your data into the

website and cause an error. Be sure to follow the instructions in the yellow

boxes on each tab of the Excel. There

are comments in each column’s header cell. Hovering your mouse over them will

provide the proper data format, whether it is required, and the description.

Once you have populated the Excel template with your

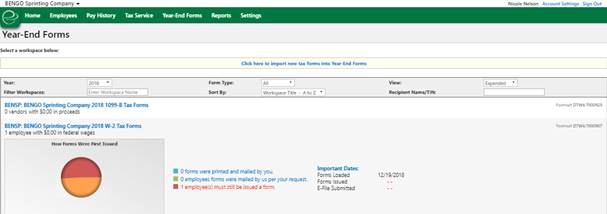

employee/form data, navigate to the Year-End Forms import wizard by:

1.

Logging into your GreenshadesOnline.com account

2.

Click on the ‘Year-End Forms’ tab within top

navigation

3.

Click the ‘Click here to import new tax forms

into Year-End Forms’ link centered at the top of the page

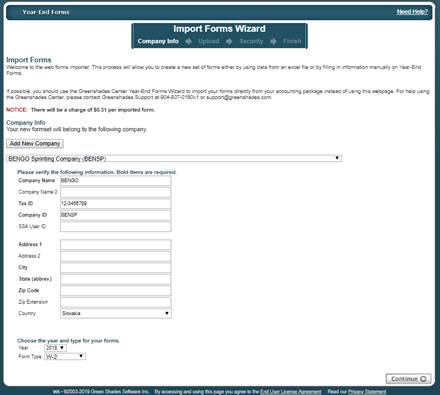

You will now begin the importing process. Year-End Forms

will first gather information about your company. If you have previously

uploaded to Year-End Forms, you may use your existing company information by

selecting your company from the drop-down list.

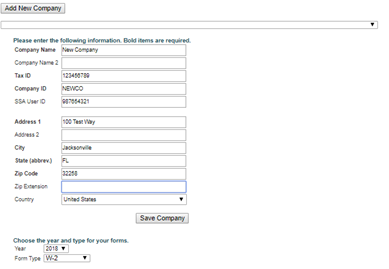

This functionality

will allow you to add new companies ahead of importing, if needed.

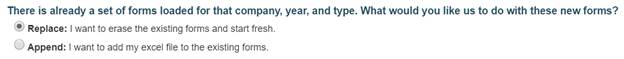

Once you have selected a company to work with, you will

select the Year and Form Type for which you want to import. If you are using a

company with existing forms, you will be presented with options to either

‘Replace’ the existing formset or ‘Append’ (add to)

the existing formset.

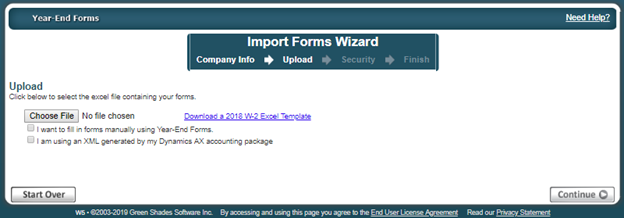

Next, upload your completed Microsoft Excel template file.

Click the ‘Browse’ button, locate your completed Excel file for import, and click

‘OK’. Then click the ‘Continue’ button.

You may choose to skip the upload and

fill in forms manually using Year-End Forms by checking the checkbox (as seen

above), however for this guide we will continue with the uploading method.

Next, you will be presented

with the option to grant access to administrators within your company to the

forms. If you do not already see their name and email address listed, you may

add them at a later time. Any administrators selected on this page will be set

as Super Administrators. See Section 1.1.3 to walk through how to set limited access administrators for formsets.

Once you’ve selected your

administrators, click ‘Continue’.

Year-End Forms will begin to import your forms. It may take some time to

import your data and create the formset based on the size of your excel file

and your position the queue.

If you remain on the current

screen, you will be provided with a ‘Continue’ button when your forms have

imported successfully. This will open the Welcome Wizard for your new W-2

formset.

If you leave the import

screen, your new formset will appear on your GreenshadesOnline.com workspace

homepage and will be listed as ‘New’ when it has completed and succesfully

imported. When you are ready, select the formset and complete the welcome

wizard as described in Section 1.3

below.

1.3

Configuring a New Formset

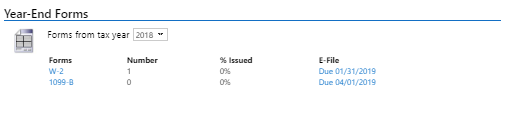

Once your form data has been uploaded into a new formset on Year-End Forms, authorized administrators can

start completing the year-end forms process.

Dependent on the form type you are uploading, the first time

that you log into the new formset on Year-End Forms,

you may be presented with a Welcome Wizard, which will walk you through some

setup steps for your new formset. As an example, the

steps for the W-2 Welcome Wizard are explained in detail below. Once completed,

you can return to the Welcome Wizard at any time from

the formset homepage by clicking the ‘Complete

Company Setup’ link.

1.3.1 Company

Information

For the first step of the Welcome Wizard, you must verify

basic company information and designate a billing contact. This page will ask

you for your Official Company Name, EIN, and a billing contact. If the billing

contact drop-down list does not contain the person you wish to designate,

select ‘[Add a New Contact]’ to enter the correct contact’s information. Adding the appropriate billing contact is important, as

this will be the point of contact regarding billable services on Year-End

Forms, including:

·

Form Uploads

·

Mailing fees for the Greenshades Mail Service,

including preference charges, additional pages, and foreign postage

·

Federal E-Filing Services

·

State E-Filing Services

·

Form CD orders

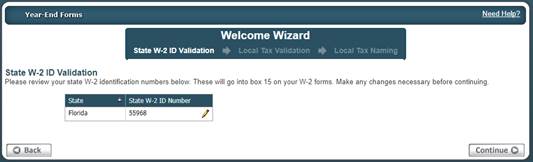

1.3.2 W-2 State ID Validation

Only

available for W-2 formsets

The W-2 Welcome Wizard will accept any State W-2 IDs that

were included with the state wages and taxes reported on your W-2 forms from

your source payroll package or excel template and will prompt you to verify

them. To assist you with this, Year-End Forms will provide you a list of all

the W-2 State IDs found within your data and warn you if any of these IDs are

not in the proper format. Please verify each ID for accuracy. You may edit an

ID by clicking the pencil icon and modify the ID in the text box provided. The

State’s ID will be updated on all W-2s, where applicable.

It is worth noting that if the ID is not correct, it means

that the ID stored in your accounting software is also incorrect. You should

ensure that you correct it at the source, as well as within this formset.

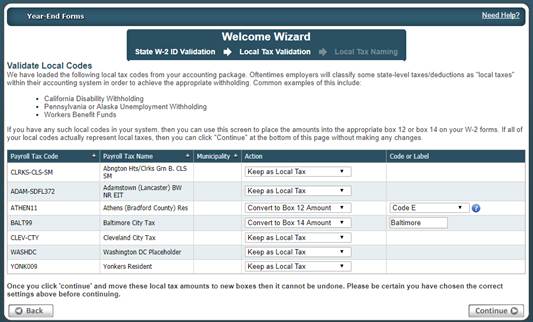

1.3.3 Local

Tax Validation

Only

available for W-2 formsets

If your upload data contained local tax withholding

information, this next step of the W-2 Welcome Wizard will be the ‘Local Tax Validation’

page. Sometimes payroll administrators may store state level taxes or

complicated payroll deductions as local taxes within their payroll systems.

Some common examples are the California Disability Withholding (SDI), Alaska or

Pennsylvania Unemployment Withholding, various Worker Benefit Fund deductions,

etc. Since these taxes/deductions were stored as locals in the source payroll

package they will be loaded into the local boxes on your W-2 forms.

This step also allows administrators to map these deductions

to their correct Box 12 and/or Box 14 locations. The figure above shows an

administrator that will convert two of the incoming local tax codes into a Box

12 and Box 14 amounts, adding in the correct codes and labels respectively.

Once converted from a local code into another form, it cannot be undone. Any

locals that are not converted into a Box 12 or Box 14 amount will appear in the

‘Locals’ section of the W-2 forms.

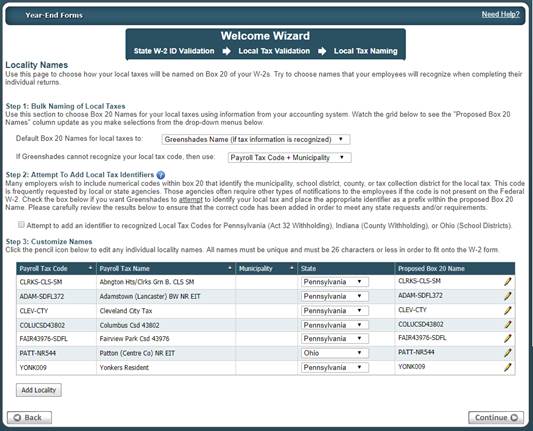

1.3.4 Local

Tax Naming

Only

available for W-2 formsets

This step in the W-2 Welcome Wizard is once again specific

to administrators who are uploading tax forms with local withholding

information. This step allows the administrator to choose how each local

withholding code should be named when appearing on the W-2 form.

To begin, the administrator will select a bulk/default name

convention for all local codes. For example, choosing ‘Payroll Tax Code +

Municipality’ (as shown above) will label each local withholding amount with

your accounting package’s payroll tax code and municipality. Next, you can edit

the names of any individual local tax code to any desired label. The names for

local taxes are limited to 26 characters to fit onto the W-2 form and must be

unique.

For additional support please contact us.

(888) 255-3815 ext.1